There are similar forces at work when you accept a debt obligation and accept a restricted charitable grant or gift. Both entail a kind of indenture, defined as a “legal contract that reflects or covers a debt or purchase obligation”. In the former case, it is a promise to repay a debt, with the penalty for non-repayment usually being damage to creditworthiness and the (re)possession of debtor assets. In the latter, it is a promise to deliver a certain program, service, or product that fulfills the organization’s charitable purpose. The penalty for failing to satisfy the restrictions of the grant mirror those of the debtor: the trustworthiness of the grantee may be harmed, such that the funder may not make another grant to that person or organization. Philanthropies, of course, do not require collateral or place liens to secure their funding, but grant agreements frequently include claw-back provisions for the funder to repossess unspent (and sometimes even spent!) funds if restrictions are incurably violated. Though differing in degree, both entail a similar kind of quid pro quo wherein the assertion of power and control favors the grantor or creditor over the debtor or grantee.

The heuristic similarities–social, psychological, legal, and structural–between debtor-creditor and grantor-grantee (restricted) relationships became an interest of mine after reading the work of economist Michael Hudson. He argues for the urgent need to center and understand the role of debt in our contemporary political economy, where it is currently absent. To ignore debt would be to dismiss a history and contemporary use of debt as a dominant force of subjugation, extraction, and peonage (or “debt slavery”), up to the present day. Hudson’s not alone in this analysis; there is ample literature on the financial bondage wrought by capitalism. An exploration of the structural relationship between philanthropy and banking in the nonprofit sector, as viewed through the lens of debt, will be a thread in our exploration of the Undersector. It is one of the ways in which private sector ideas have poisoned the well of the nonprofit sector, potentially driving us to satisfy our thirst for better social economies elsewhere.

In a gesture of political activism with talismanic impulses, debt slavery is recognized in the form of a commemorative coin.

Hudson’s seminal Finance as Warfare (World Economics Association & College Publications, 2015) tracks the history of debt as a powerful tool of economic enclosure–acquisition and possession. The negative forces of debt were considered so powerful and disruptive of civil society in ancient Sumer and Babylon that kings would regularly declare “debt jubilees”, which entailed the wholesale cancellation of all debts throughout their domain–a hard reset for society.

The motive for debt jubilees was not mercy or generosity, it was out of practical concern for maintaining social order and avoiding violent rebellion. Ancient Eurasian societies generally exhibited three social classes: a noble/ruling class, a farming/labor class, and a kind of middle “creditor class”. Also practiced at this time was corvée labor (labor for the government on public works, defense, and foodways in lieu of taxes) and debt peonage (the indenturing of an individual to labor in order to repay a debt, or “debt slavery”). Most debts were incurred by farmers owing some balance of payments to creditors or the king resulting from the vagaries of annual crop yields. If over time too many citizens found themselves as slaves (literally) to their creditors, social upheaval would become a threat. Thus the need for debt jubilees.

The parallels to the Biden administration’s proposal to cancel student debt may seem tempting, but there is a critical difference. Biden is proposing to cancel the state’s portion of those debts, which it has the authority to do via congress. A true, contemporary debt jubilee for students would include the government being able to cancel all private debt as well, an idea that strikes so violently at the heart of neoliberal political economy as to be practically unthinkable.

The idea of debt as an durable obligation that can be passed across generations, bought and sold, immune to cancellation by the state, and endures until satisfied, is a product of the Early Modern political economy, barely 500 years old. This concept of debt lies at the heart of how we define “private property” today, for which land is the archetype. Hudson tracks the evolution from antiquity forward of a dominant “creditor-oriented legal system, which makes forfeiture or other alienation of land irreversible. This quality of being freely alienable and liable for expropriation by creditors is what makes modern property ‘private’”.

While the sovereigns of antiquity were concerned about avoiding rebellion, debt became a major weapon in war (literally and figuratively) in matters of statecraft in the Early Modern era. Rival countries like England and France had to decide between taxing their citizens for the cost of waging war, or borrowing money to do so. The latter became a much more politically agreeable path and contributed to the formation of our modern macroeconomic system and balances of accounts between nations. For example, the Dutch ended up owning substantial shares in crown monopolies and other state assets of both England and France through financing their wars and collecting the debts. Countries were compelled to privatize land and other state assets in order to use them to settle with creditor nations. Hudson draws a direct line between the forced forfeiture of assets as the result of debt and the conquering and possessing motivations of actual war. Per Hudson, “The traditional objective of warfare–conquest of the land and natural monopolies to siphon off their rent–remains the objective of today’s high finance. The difference is that rentier [nation’s] wealth is now obtained more peacefully…”

The news cycle today is crammed with the exploits–and mostly folly–of international economic policy. Though a few weeks old (I was late to the party), the article “Ecuador Tried to Curb Drilling and Protect the Amazon. The Opposite Happened” (Catrin Einhorn and Manuela Andreoni, The New York Times, originally published January 14, 2023) is an alarming and all-too-common study in the adverse use of modern debt. It’s not every day that we encounter such a teachable example of Hudson’s finance-as-warfare analysis, and some of its implications for philanthropy.

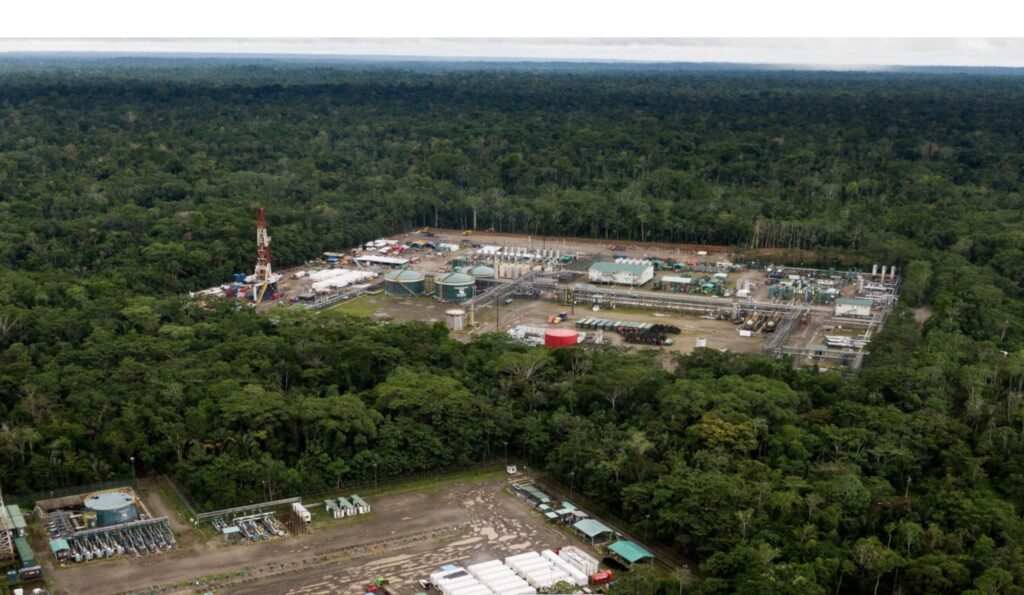

The article concerns the Yasuní National Park in Ecuador, which is one of the most biodiverse places on earth, and more specifically a part called Block 43, which became the location of a tragic war on the environment waged by the forces of debt. Per the authors, Ecuador is one of the most economically distressed countries in Central America, with one in four children suffering malnutrition. One-third of the country’s GDP is derived from oil, most of which lies beneath the Amazon rainforest. Drilling would cause catastrophic damage to the ecology of the forest and contribute substantially to the growing climate crisis. In 2007, then president Rafael Correa floated a novel proposal. He asked other countries to pay Ecuador not to drill for oil, to the tune of about $3.6 billion, or half the value of its oil. The difficult choice to destroy an essential natural resource in order to access another asset (oil) was made all the more impossible by the economic urgency of the situation. In the end, the scheme failed, only raising about $13 million and forcing Ecuador to borrow $8 billion from China to keep the country afloat–a debt that ended up getting paid in oil and the continued destruction of one of the world’s great natural resources. Ecuador gained some needed income, but lost irretrievable resources, and in the end, we all were victims of the environmental impact.

The scars left by debt on Ecuador’s rainforest. Photo by Erin Shaff for The New Your Times.

The initial request for subsidy from the international community was stymied by some (perhaps) founded doubts of Carrera’s creditworthiness as a leader and other political considerations. But the most striking line of the article for me was: “Many [nations] seemed perplexed by the idea of paying a country not to do something” (the authors referring to the funds solicited in order to prevent Ecuador from having to drill). In making this appeal, Carrera was asking for a subsidy–the state equivalent of philanthropy–from other countries to help his people and avoid the global harm of environmental destruction. Government subsidy usually takes the form, explicitly or implicitly, of a restricted grant, in that it is given to protect some interest of the state, but not with a direct quid pro quo.

This was by no means an extraordinary proposition from Ecuador. Governments subsidize things everyday, both for internal social benefits (e.g., scientific research, land conservation, arts and culture, low-income housing) and external benefits and international interests, such as contributing to NATO or the war in Ukraine. It is also commonplace for governments to subsidize private business and other interests not to do something. In the U.S. the federal government has long subsidized farmers not to plant certain crops in the interest of addressing other market interests while allowing the farmers to keep operating. The U.S. does this precisely to avoid forcing farmers into debt slavery. The alternative for many farmers would be the incursion of debt, and ultimately, the likely alienation of their land through sale of the farm, either to avoid debt or satisfy a creditor.

Clearly in the case of Ecuador’s appeal, the proposition of “do the right thing for global warming and ecological conservation” by paying us not to drill oil was not a sufficient value proposition to its international peers. Instead, a more direct exchange was demanded resulting in debt. You could call this a failure of international philanthropic intent, an unwillingness to recognize the greater social good, or simply a failure to frame the “ask” well. A more pessimistic (and perhaps realistic) reading would lead us to the conclusion that debt enslavement of Ecuador and extraction, in this case literally, was the international game all along.

Either way, this case shows the close and complex interplay between the uses of debt and restricted philanthropy (or state subsidy) in contemporary political economy. Both debt and restricted philanthropy, as progeny of modern capital markets, are wielded in powerful ways to shape the fate of people and the planet. Why then, is neither included in contemporary macroeconomic theory and political economy? I suspect this is not just a simple error of framing but rather an intentional desire to mask the interests of private and state actors in using both debt and philanthropy to exert control (in the form of rent, alienation, possession, or determinate outcomes). The result is almost always and ultimately harm, wrought in the name of “business as usual”.